Average Food Cost Per Month 2024 [How Much Should I Spend?]

Understanding how much you spend on food each month can provide a clear picture of your financial health.

Knowing the average food cost per month helps you chart a practical budget, ensuring that your hard-earned dollars are being spent mindfully. It's an essential step towards smart grocery spending and savings.

Discussing the average monthly food cost isn't just for finance nerds or meal planners; it's crucial to keeping your financial life in balance.

As simple as it might sound, this knowledge could be the catalyst that drives your journey towards better fiscal responsibility and healthy eating.

With this understanding, nothing stops you from enjoying your favorite meals while keeping your finances intact.

Skip Ahead

Average Food Cost per Month for U.S. Households

The average monthly food cost for U.S. households varies greatly depending on the size and income level of the household.

As per the U.S. Bureau of Labor Statistics 2019, the average U.S. household spent $4,643 on groceries, or approximately $387 per month.

This does not include dining out, which added $3,526 annually or nearly $294 per month to food costs, bringing the total to about $681 monthly expense on food for an average U.S. household.

USDA Average Food Cost per Month for a Single Person

As you set out to understand your monthly food cost, the United States Department of Agriculture (USDA) provides a handy food plan that breaks down spending into four categories: Thrifty, Low-cost, Moderate-cost, and Liberal.

The USDA bases these plans on the assumption that all meals and snacks are prepared at home. Consider these categories as you evaluate your grocery budget.

Thrifty

The USDA estimates that a single woman can expect to spend approximately $295 monthly at the most economical end of the spectrum, while a single man might be closer to $365.

This "Thrifty" plan indicates minimal spending without considering dietary restrictions or specific eating behaviors.

This budget represents the most value-driven choices, involving more cooking from scratch, limited dining out, and leveraging savings techniques like bulk buying and coupon use.

Low-cost

The low-cost plan is one step above thrifty in terms of spending. The average monthly cost for women rises slightly to $315, while for men, it's around $355.

These modest increases represent those who may allow more variety in their diets or perhaps occasionally splurge on premium items while maintaining a relatively conservative budget framework.

Moderate cost

The USDA's moderate meal cost plan may suit those who enjoy home-cooked meals, healthy options, and infrequent restaurant nights.

Predictably higher than low-cost options, here's where gender-specific spending diverges more noticeably: women could expect an average monthly bill of about $380, while men would face around $445.

A moderate spender might prefer organic options more frequently or lean towards pricier protein options.

Liberal

The "Liberal" plan, as outlined by the USDA, is the highest level of monthly food spending. This plan is tailored towards those who don’t have many restrictions on their grocery budget and can afford to buy premium foods frequently.

For a single woman, these costs are, on average, $485 per month, and for a single man, around $550 per month.

A liberal spender often splurges on luxury items such as gourmet cheeses, prime cuts of meat, or out-of-season produce.

They spend less time comparing prices or hunting down sales and gravitate towards organic selections, high-end brands, and possibly frequent dining-out experiences.

Also Read: Average Vacation Cost 2024 [Lodging, Food & Transportation]

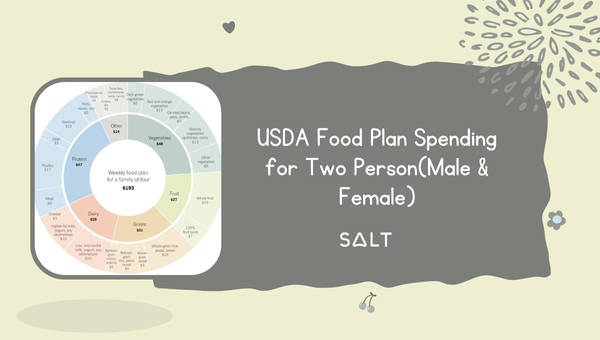

USDA Food Plan Spending for a Two-Person Household (Male & Female)

When food budgeting for two people residing in the same household, it's essential to consider both individuals' eating patterns and preferences to account for trend variations. Let's examine the four USDA plans for a two-person household.

Thrifty

According to the USDA, a thrifty budget plan could expect to look at approximately $595 per month.

This implies meticulous meal planning and shrewd shopping techniques that optimize perceived value while considering both partners' dietary needs.

Opting for lower-cost products such as grains and seasonal fruits and vegetables while limiting pricier protein sources could be a strategic move at this spending level.

Low-cost

The average low-cost food budget plan shows a slight monthly uptick from the thrifty plan, at around $600.

While this bump may seem trivial, it could afford more flexibility in experimenting with diverse meals or occasionally incorporating higher-quality ingredients into your diet.

Careful consideration of sale items, attractive deals, shopping at discount grocers, or using loyalty programs would help maintain this figure without compromising on nutrition or variety.

Moderate cost

For those willing to extend their food expenditure further, a moderate-cost food plan averages around $760 per month.

This added expense could provide the luxury of exploring various fresh produce that would typically stretch beyond the budget of a strict low-cost plan.

Here's where moderate diners might indulge in seafood more frequently or invest in organic options whenever possible.

Liberal

Significantly higher than the previous plans, households on a liberal food costing plan would likely spend about $945 monthly on average.

This expanded monetary allowance might enable you to purchase more expensive items freely, like top-tier meats, gourmet cheeses, and exotic fruits, without stressing over cost implications constantly.

While each spending level reflects an estimated average monthly figure based on historical costs reported by American families nationwide, individual prices can sway widely depending on your dietary habits and local grocery costs.

This includes whether you're based in an urban or rural area, wherein fees can fluctuate substantially.

USDA Average Food Cost per Month for a Family of 4

Managing household expenses can be tricky, especially when budgeting for food. It would be best if you considered not only your family's dietary preferences but also the pricing variances from grocery store to store and region to region, not to mention the constant fluctuations in food prices.

Thankfully, the USDA provides an average monthly food cost that can serve as a guideline to help you navigate this budgeting concern effectively.

Thrifty Plan: $970

The Thrifty Plan is designed for families who need to stretch their dollars as far as possible. This plan, which averages out to about $970 per month for a family of 4, uses strategies such as meal planning, buying in bulk, using coupons, being ready to take advantage of sales, and cooking at home.

It's essential with this plan also to focus on nutritious yet affordable staples - think brown rice, oats, frozen fruits and vegetables, chicken breasts, and eggs.

Low-Cost Plan: $1,050

The Low-Cost plan offers slightly more wiggle room at around $1,050 per month for a family of four. While still focusing on saving strategies such as buying items on sale or with coupons and preparing meals at home tightly bound to a planned menu-it allows some leeway.

This may include occasionally incorporating pricier proteins or snacks into meals or experimenting with a wider variety of foods without straining the family budget.

Moderate-Cost Plan: $1,350

The Moderate-Cost Plan provides even more flexibility in the household grocery budget. Averaging around $1,350 monthly for a family of four plan can accommodate purchasing higher-end items like organic produce or nutrient-dense snacks more frequently than the previous two plans.

It also allows more freedom to eat in restaurants or takeaway meals without drastically disrupting your budget.

Liberal Plan: $1,500

At an average cost of approximately $1,500 per month for a family of four-the Liberal Plan is best suited for households who remember that "you are what you eat."

This might mean you prioritize organics across all food groups, free-range meats, invest more heavily in fresh vegetables/fruit, or perhaps experiment with gourmet meals regularly.

Whatever your dietary preferences, this entails being less constrained by price than others, making it possible to have an eclectic menu rotation inclusive of even convenience foods or restaurant dining.

Also Read About Average Wedding Costs By State [2024 Latest Statistics]

How To Stretch Your Grocery Budget

Smart grocery shopping can stretch your dollars, allowing you to enjoy more foods you love without sacrificing quality or health.

Here are some proven strategies to maximize your grocery budget, maintain a balanced diet, and reduce overall food expenses.

Stick To The Shopping List

A golden rule for budget shoppers is sticking to a pre-planned shopping list. Before heading to the store, consider your meals for the week and note down necessary ingredients.

A shopping list prevents impromptu purchases, which typically inflate grocery bills and lead to waste.

Plan meals around weekly sales or seasonal produce to further bolster this strategy. A strictly followed shopping list is a powerful tool in combating overspending.

Buy In Bulk

Purchasing food staples in bulk often reduces the cost per unit or weight compared to buying items individually, which can add significant savings over time.

This method is particularly effective for non-perishable goods like pasta, grains, canned foods, or condiments with extended shelf-life.

Additionally, buying larger quantities of meat during sales and portioning it into meal-sized freezer bags for later use can be an effective money-saving tactic.

Utilize Coupons and Loyalty Programs

Leveraging coupons and loyalty programs is a savvy trick to slicing your food budget down to size.

Coupons could shave off significant dollars from your bill, mainly if you use them strategically for items you regularly buy.

Numerous mobile apps and websites provide access to digital coupons that make this process more accessible than ever.

Likewise, many grocery stores have loyalty programs offering member-exclusive discounts. Some even provide points that accumulate over time, eventually reaching a redeemable amount directly deducted from your bill.

Opt For Generic Brands

When you often pay for name brands, a part of what you buy is the brand's reputation or packaging - not necessarily a superior product.

So, next time you're at the grocery store, why not give generic brands a shot? Usually found alongside their name-brand counterparts, these items carry lower price tags while offering similar quality.

Read the ingredients or nutritional contents; you may be surprised at how comparable generic brands are to their pricier counterparts.

Think of it this way: every dollar saved here can go towards other essentials or even an occasional treat.

Cook at Home Frequently

Surprisingly, to some, dining out frequently can significantly bump up your monthly food cost. Beyond just the cost of meals, taxes and tips also add up quickly when eating out or ordering delivery.

Shifting towards having more home-cooked meals can significantly impact your monthly expenditure; it's astonishing how many meals you can prepare at home for the price of one restaurant dinner.

Plus, cooking at home often leads to healthier meals since you control ingredients and portion sizes.

Plan Meals in Advance

Regarding efficiency in grocery spending and eliminating food waste - meal planning is king! Knowing precisely what's on the menu for the week lets you shop smartly and avoid buying unnecessary extras that spoil in the fridge.

Plan meals around what’s already in your pantry or based on what’s on sale that week at your local store.

Essentially, buying only what is required could save money while preventing stress about deciding daily 'what's for dinner?' Notably?

Meal planning also promotes healthier eating habits as it prevents last-minute unhealthy food or takeout decisions.

Shop Sales and Discounted Items

Who doesn't love a good bargain? Shopping sales and discounted items are two meaningful ways to decrease monthly food costs while enjoying your favorite dishes.

Keep an eye out for weekly sale flyers from your local grocery stores; they'll highlight the top deals for the week.

You can strategically plan your meals around these sales. From dairy products to canned goods, fresh produce, meats, and non-perishables – every department will have specials at some point.

These are often treasure troves of heavily discounted items nearing their sell-by dates but are still perfectly safe to eat.

Avoid Shopping When Hungry

Entering a grocery store with a growling stomach can lead to disastrous spending results. Hunger can trigger impulse purchases, which add up quickly and distort your carefully planned budget.

Studies have shown that when you're hungry, you aren't just appetized by food; you want more of everything.

So even non-food items start looking attractive! To avoid this pitfall, try eating a snack or a light meal before going grocery shopping — it might save you from those unneeded chocolate bars or that bag of salted chips that spontaneously land in your cart.

Store Excess Food In the Freezer

Storing excess food in the freezer is a straightforward way to stretch your budget. Leftovers? Into the freezer! Did you buy too much meat on sale? Freeze it!

Freezing reduces waste by preserving foods until you need them – and less waste equals more savings over time.

Additionally, frozen foods maintain nutritional value, so it’s a win-win situation! Ensure all items are properly sealed in air-tight containers or bags specifically designed for freezing, as this prevents freezer burn and extends shelf life.

Use Budgeting Apps To Monitor Spending

In today's digital age, using budgeting apps can effectively monitor your monthly spending on groceries and dining out expenses.

Apps like Mint, YNAB (You Need A Budget), and Personal Capital provide beautiful visuals tracking where every dollar goes while setting an overall budget limit per category, e.g., groceries or dining out.

They even offer alerts when you exceed budgeted amounts, which nudges mindful spending habits over time.

FAQs about average food cost per month

What is the average cost of groceries per month for one person in the United States?

The average monthly grocery cost for one person on a thrifty plan in the United States can range from $165 to $345, depending on the individual's age and gender.

How can you reduce your monthly food expenses?

Simple ways to cut food expenses include sticking to a budget, meal planning, shopping sales or discounted items, buying in bulk, cooking at home more often, and reducing waste.

Does the average monthly food cost include dining out?

While some calculations might include dining out, USDA food plans and many budgeting estimates typically only account for groceries and at-home meals.

What factors affect your monthly food costs?

Several factors can influence your monthly food costs, including family size, geographic location, dietary needs or restrictions, personal taste preferences, and lifestyle choices.

How does the USDA categorize different levels of food spending?

The USDA uses four categories to describe levels of food spending: thrifty, low-cost, moderate-cost, and liberal.

Conclusion

Understanding your average food cost per month is vital. It can help illustrate a clearer financial picture and guide grocery shopping decisions.

Knowledge of these costs empowers one to make the best choices based on personal needs, diet, lifestyle, and budget.

Balancing nutritional requirements and financial limits is made easier when using tools like the USDA's monthly food plans.

Remember that there’s no correct amount to spend on groceries; we all have different lifestyles and needs. Understanding averages can serve as a beneficial guide in navigating this significant aspect of everyday life.

Michael Restiano

I support product content strategy for Salt Money. Additionally, I’m helping develop content strategy and processes to deliver quality work for our readers.